| Author |

Message |

|

|

|

|

|

Advert

|

Forum adverts like this one are shown to any user who is not logged in. Join us by filling out a tiny 3 field form and you will get your own, free, dakka user account which gives a good range of benefits to you:

- No adverts like this in the forums anymore.

- Times and dates in your local timezone.

- Full tracking of what you have read so you can skip to your first unread post, easily see what has changed since you last logged in, and easily see what is new at a glance.

- Email notifications for threads you want to watch closely.

- Being a part of the oldest wargaming community on the net.

If you are already a member then feel free to login now. |

|

|

![[Post New]](/s/i/i.gif) 2012/10/22 22:57:03

Subject: Its Turns out Trickle Down Economics Doesn't Work

|

|

Mutated Chosen Chaos Marine

|

Well, it does work if what you mean is that gak is trickling down onto the poor people, but otherwise it doesn't. Look at this new Congressional report, with all sorts of pretty graphs and legitimate sources.

http://graphics8.nytimes.com/news/business/0915taxesandeconomy.pdf

|

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/23 02:44:01

Subject: Re:Its Turns out Trickle Down Economics Doesn't Work

|

|

Fixture of Dakka

|

It's nice to see all the added details, but it's been obvious it doesn't work for five years now.

Thesis: When the rich have more money and pay less taxes, they create more jobs.

FACT: Tax rates are at historic lows.

FACT: Corporations are posting record profits.

FACT: The top 1% has more proportional wealth than they have since the 1930s.

FACT: There are very few new jobs being created.

Conclusion: MYTH BUSTED.

|

CHAOS! PANIC! DISORDER!

My job here is done. |

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/23 02:45:47

Subject: Re:Its Turns out Trickle Down Economics Doesn't Work

|

|

[DCM]

Tilter at Windmills

|

Vulcan wrote: Vulcan wrote:It's nice to see all the added details, but it's been obvious it doesn't work for five years now.

I think you mean thirty. Incomes have been going down for the middle class and up for the rich for decades. Look at the proportional difference between CEO pay and the average worker at their company. The differential has skyrocketed up and up.

|

Adepticon 2015: Team Tourney Best Imperial Team- Team Ironguts, Adepticon 2014: Team Tourney 6th/120, Best Imperial Team- Cold Steel Mercs 2, 40k Championship Qualifier ~25/226

More 2010-2014 GT/Major RTT Record (W/L/D) -- CSM: 78-20-9 // SW: 8-1-2 (Golden Ticket with SW), BA: 29-9-4 6th Ed GT & RTT Record (W/L/D) -- CSM: 36-12-2 // BA: 11-4-1 // SW: 1-1-1

DT:70S++++G(FAQ)M++B++I+Pw40k99#+D+++A+++/sWD105R+++T(T)DM+++++

A better way to score Sportsmanship in tournaments

The 40K Rulebook & Codex FAQs. You should have these bookmarked if you play this game.

The Dakka Dakka Forum Rules You agreed to abide by these when you signed up.

Maelstrom's Edge! |

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/23 03:08:22

Subject: Its Turns out Trickle Down Economics Doesn't Work

|

|

Hardened Veteran Guardsman

Australia

|

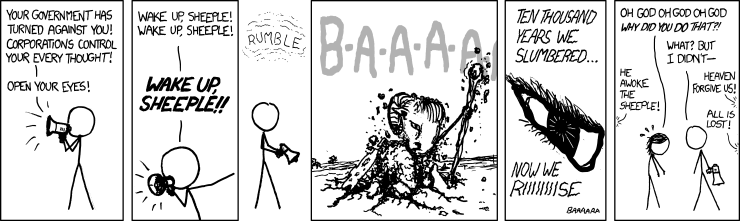

This is clearly a ploy by the socialist atheist agenda of Obama. He obviously signed off on this while reading his Quran.

Wake up sheeple!

|

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/23 03:13:43

Subject: Its Turns out Trickle Down Economics Doesn't Work

|

|

Posts with Authority

|

MrScience wrote: MrScience wrote:This is clearly a ploy by the socialist atheist agenda of Obama. He obviously signed off on this while reading his Quran.

Wake up sheeple!

Quite.

|

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/23 03:14:49

Subject: Its Turns out Trickle Down Economics Doesn't Work

|

|

Fixture of Dakka

|

MrScience wrote: MrScience wrote:This is clearly a ploy by the socialist atheist agenda of Obama. He obviously signed off on this while reading his Quran.

Wake up sheeple!

I hope to God you just forgot the [/sarcasm] at the end of your post...

|

CHAOS! PANIC! DISORDER!

My job here is done. |

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/23 03:15:51

Subject: Re:Its Turns out Trickle Down Economics Doesn't Work

|

|

Decrepit Dakkanaut

|

I'm on vicoden and Lunesta....why would I want to wake up and be a sheple?

|

Proud Member of the Infidels of OIF/OEF

No longer defending the US Military or US Gov't. Just going to ""**feed into your fears**"" with Duffel Blog

Did not fight my way up on top the food chain to become a Vegan...

Warning: Stupid Allergy

Once you pull the pin, Mr. Grenade is no longer your friend

DE 6700

Harlequin 2500

RIP Muhammad Ali.

Jihadin, Scorched Earth 791. Leader of the Pork Eating Crusader. Alpha

|

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/23 03:42:54

Subject: Its Turns out Trickle Down Economics Doesn't Work

|

|

Kid_Kyoto

|

What have you done?!

|

|

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/23 04:17:01

Subject: Re:Its Turns out Trickle Down Economics Doesn't Work

|

|

Depraved Slaanesh Chaos Lord

|

Dammit, you beat me to the XKCD comic.

Anyway, yeah, yet another report to prove the obvious truth that workers are hired only as an absolute necessity, and would not be paid if the employer could avoid it.

|

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/23 11:28:19

Subject: Its Turns out Trickle Down Economics Doesn't Work

|

|

[MOD]

Anti-piracy Officer

Somewhere in south-central England.

|

I remember when Thatcher and Reagan were talking about "trickle down" in the early 1980s, a commentator described it as the notion that by feeding more high quality grain to horses, there will be more husks in the horse droppings for sparrows to glean.

|

|

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/23 11:39:37

Subject: Re:Its Turns out Trickle Down Economics Doesn't Work

|

|

Decrepit Dakkanaut

|

I think it would work, if the rich actually used that money for things that would stimulate the economy. Problem is....it mostly doesnt, and when they arnt buying expensive imports from other countries, they are just hording their money.

|

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/24 01:17:56

Subject: Re:Its Turns out Trickle Down Economics Doesn't Work

|

|

Fixture of Dakka

|

Of course rich people don't spend their money - having that money in the bank is what makes them rich in the first place!

Rich people spend only a very small portion of their annual income and save the rest. They can afford to. Contrast this with a middle-class person, who is doing very well to save a tenth of what they earn in a year.

Then tell me again how giving money to someone who saves the majority of what they get - which removes it from the economy - is somehow better than giving money to someone who will spend 90% of it - which RETURNS it to the economy!

|

CHAOS! PANIC! DISORDER!

My job here is done. |

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/24 02:37:51

Subject: Its Turns out Trickle Down Economics Doesn't Work

|

|

[DCM]

Tilter at Windmills

|

The contrary argument is that they do put into the economy through investment, and that's why we tax capital gains at a lower rate; to encourage that investment.

That being said, yeah, putting more money in the hands of people who will actually spend it does act as more immediate and consistent economic stimulus.

|

Adepticon 2015: Team Tourney Best Imperial Team- Team Ironguts, Adepticon 2014: Team Tourney 6th/120, Best Imperial Team- Cold Steel Mercs 2, 40k Championship Qualifier ~25/226

More 2010-2014 GT/Major RTT Record (W/L/D) -- CSM: 78-20-9 // SW: 8-1-2 (Golden Ticket with SW), BA: 29-9-4 6th Ed GT & RTT Record (W/L/D) -- CSM: 36-12-2 // BA: 11-4-1 // SW: 1-1-1

DT:70S++++G(FAQ)M++B++I+Pw40k99#+D+++A+++/sWD105R+++T(T)DM+++++

A better way to score Sportsmanship in tournaments

The 40K Rulebook & Codex FAQs. You should have these bookmarked if you play this game.

The Dakka Dakka Forum Rules You agreed to abide by these when you signed up.

Maelstrom's Edge! |

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/24 02:39:06

Subject: Its Turns out Trickle Down Economics Doesn't Work

|

|

Longtime Dakkanaut

|

You're 30 years too late

|

Unnessesarily extravegant word of the week award goes to jcress410 for this:

jcress wrote:Seem super off topic to complain about epistemology on a thread about tactics.

|

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/24 02:55:22

Subject: Re:Its Turns out Trickle Down Economics Doesn't Work

|

|

The Dread Evil Lord Varlak

|

The theory begins and ends it's complete fail when it pretends that it is only the wealthy that invest. That was probably true in 1800, but the rise of middle class has meant for at least a century the primary source of investment funds has been the savings of the middle class. The whole banking system is basically a vehicle for the savings of the middle class to be lent out to the wealthy investor class for investment.

|

“We may observe that the government in a civilized country is much more expensive than in a barbarous one; and when we say that one government is more expensive than another, it is the same as if we said that that one country is farther advanced in improvement than another. To say that the government is expensive and the people not oppressed is to say that the people are rich.”

Adam Smith, who must have been some kind of leftie or something. |

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/24 06:16:58

Subject: Re:Its Turns out Trickle Down Economics Doesn't Work

|

|

Hangin' with Gork & Mork

|

Disney tried to warn us years ago about how the wealthy really use their money.

|

Amidst the mists and coldest frosts he thrusts his fists against the posts and still insists he sees the ghosts.

|

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/24 14:38:06

Subject: Its Turns out Trickle Down Economics Doesn't Work

|

|

Fireknife Shas'el

|

Mannahnin wrote: Mannahnin wrote:The contrary argument is that they do put into the economy through investment, and that's why we tax capital gains at a lower rate; to encourage that investment.

That being said, yeah, putting more money in the hands of people who will actually spend it does act as more immediate and consistent economic stimulus.

That brings up something I have always wondered about trickle down. We know giveing rich people money dosen't mean much because they don't reinvest that into the economy, but what about corporations? A business will spend all there money and then get a lone so they can spend more. What would happen if we just cut the corporate tax to 0?

|

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/24 15:08:34

Subject: Its Turns out Trickle Down Economics Doesn't Work

|

|

Mutilatin' Mad Dok

SE Michigan

|

nomotog wrote:

That brings up something I have always wondered about trickle down. We know giveing rich people money dosen't mean much because they don't reinvest that into the economy, but what about corporations? A business will spend all there money and then get a lone so they can spend more. What would happen if we just cut the corporate tax to 0?

Not necessarily, Corporations will often sit on their profits to make a "war chest". This is the current economic situation, no one wants to take on risky investments/loan right now, so more corporations are playing it safe and building up their reserves.

You reduce corporate tax to zero?? You lose a lot of Income for governments and your personal taxes will increase to make up the loss or your government stops paying for services!

|

|

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/24 16:35:21

Subject: Its Turns out Trickle Down Economics Doesn't Work

|

|

Fixture of Dakka

|

Mannahnin wrote: Mannahnin wrote:The contrary argument is that they do put into the economy through investment, and that's why we tax capital gains at a lower rate; to encourage that investment.

Only they don't.

They send their money to overseas banks, or they invest in the market, buying shares in companies that they expect to pay big dividneds. And who do they buy the shares from? Most often from someone OTHER than the company - which means the company doesn't see one thin dime of the money.

Remember that: The company only gets money from sale of their stocks when they're doing the selling. Third-party sales mean nothing to the company. And money in the market tends to stay in the market, rather than get out and be used in the wider economy outside the stock exchange. Automatically Appended Next Post: nomotog wrote: Mannahnin wrote: Mannahnin wrote:The contrary argument is that they do put into the economy through investment, and that's why we tax capital gains at a lower rate; to encourage that investment.

That being said, yeah, putting more money in the hands of people who will actually spend it does act as more immediate and consistent economic stimulus.

That brings up something I have always wondered about trickle down. We know giveing rich people money dosen't mean much because they don't reinvest that into the economy, but what about corporations? A business will spend all there money and then get a lone so they can spend more. What would happen if we just cut the corporate tax to 0?

Right now corporations are playing the market rather than investing in their businesses, because they can make more money on the market with the exceedingly low capitol gains tax rate than they can by... you know, doing business.

Raise capitol gains to 35% or so and give a hefty tax break to companies for paying PAYROLL (as opposed to bonuses) and you'll see corporations fall all over themselves hiring people to save taxes.

|

|

This message was edited 1 time. Last update was at 2012/10/24 16:39:04

CHAOS! PANIC! DISORDER!

My job here is done. |

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/24 17:22:34

Subject: Its Turns out Trickle Down Economics Doesn't Work

|

|

Dominar

|

Vulcan wrote: Vulcan wrote:Raise capitol gains to 35% or so and give a hefty tax break to companies for paying PAYROLL (as opposed to bonuses) and you'll see corporations fall all over themselves hiring people to save taxes.

This idea is hilariously wrong and basically the complete opposite of anything that even begins to make intuitive sense, right down to the typo on 'capitol gains'.

Increase capital gains tax, and you create barriers to business, essentially raising the expenses of doing business. That's not even ' IMO', it's basically a textbook definition.

Then you suggest that tax breaks on head count will offset this expense, but headcount has its own expense associated with it (and a lot of front-loaded expenses, like training and the logistics of dealing with headcount expansion), so all you're really doing is giving a 'buy one, get one free... in six months' coupon. So mathematically, your equation looks like this:

Expense + (Expense/2) = Growth

|

|

This message was edited 1 time. Last update was at 2012/10/24 18:52:06

|

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/24 17:35:25

Subject: Re:Its Turns out Trickle Down Economics Doesn't Work

|

|

Imperial Admiral

|

Can't I just vote for Romney now because I make more money than I did when I voted for Obama and want to keep more of it?

|

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/25 02:24:17

Subject: Its Turns out Trickle Down Economics Doesn't Work

|

|

The Dread Evil Lord Varlak

|

nomotog wrote:That brings up something I have always wondered about trickle down. We know giveing rich people money dosen't mean much because they don't reinvest that into the economy, but what about corporations? A business will spend all there money and then get a lone so they can spend more. What would happen if we just cut the corporate tax to 0?

Any ater tax profit that is not needed for re-investment will be paid to shareholders as dividends. The problem with trickle down, essentially, is that investment isn't driven by having spare cash lying around. Neither people nor corporations look in the bank, see they've got a spare million and decide to start a new store. Investment is driven by demand - those people and corporations see there is demand in the market that is not met by them or their competitors, and they expand to meet that demand. Maybe they have the money on hand but more likely they don't, at which point they will borrow it. But the point is that investment comes from there being consumers with cash out there demanding products. This leads to investment, which leads to employment, leading to more cashed up consumers and so the feedback cycle is created. Simply having rich people with money doesn't achieve anything, if there's no investment opportunities for them to seek profits from. Automatically Appended Next Post:  Vulcan wrote: Vulcan wrote:Remember that: The company only gets money from sale of their stocks when they're doing the selling. Third-party sales mean nothing to the company. And money in the market tends to stay in the market, rather than get out and be used in the wider economy outside the stock exchange.

Umm, no. Money moved through third party sales is never "in the market". It can't be, because for every buyer putting his money in, there's a seller. I buy your BHP share for $50, and I lose $50 but you gain $50. The amount of money in the hands of people to be spent outside the market is unchanged. Automatically Appended Next Post: Right now corporations are playing the market rather than investing in their businesses, because they can make more money on the market with the exceedingly low capitol gains tax rate than they can by... you know, doing business.

Raise capitol gains to 35% or so and give a hefty tax break to companies for paying PAYROLL (as opposed to bonuses) and you'll see corporations fall all over themselves hiring people to save taxes.

Make it simpler. Drop payroll taxes. Make them not exist. Don't tax companies for hiring people. Then do something else even more radical - make company tax 30% or 35%, but stop double taxation when it's paid to shareholders - give those shareholders a tax credit for every dollar already paid on their income by the company. And don't give capital gains tax its own special treatment. Roll it up into income tax - why should it matter if I profited by selling my labour or selling some land, if either way I brought in $100,000 in the year? Any issues with spikes to income from one time sales can be dealt with under income averaging provisions that are already in place. That'll give you a healthy shortfall in tax revenue, which you make up by raising the most direct, sensible tax - income tax. Automatically Appended Next Post:  sourclams wrote: sourclams wrote:Increase capital gains tax, and you create barriers to business, essentially raising the expenses of doing business. That's not even ' IMO', it's basically a textbook definition.

Umm, a tax on profit isn't an expense of doing business, it's a profit reduction. It works entirely differently to variable and fixed expenses. Then you suggest that tax breaks on head count will offset this expense, but headcount has its own expense associated with it (and a lot of front-loaded expenses, like training and the logistics of dealing with headcount expansion), so all you're really doing is giving a 'buy one, get one free... in six months' coupon.

When something is more expensive, a buyer will buy less of it. This is what's known in economics as fething obvious. Reducing the cost of something makes a buyer buy more of it. Again, the economic term is 'fething obvious'. Reducing the cost of labour, by removing payroll tax, makes it cheaper. I hope I can now sit back and watch you put all the pieces together.

|

|

This message was edited 5 times. Last update was at 2012/10/25 02:41:28

“We may observe that the government in a civilized country is much more expensive than in a barbarous one; and when we say that one government is more expensive than another, it is the same as if we said that that one country is farther advanced in improvement than another. To say that the government is expensive and the people not oppressed is to say that the people are rich.”

Adam Smith, who must have been some kind of leftie or something. |

|

|

|

|

![[Post New]](/s/i/i.gif) 2012/10/25 02:50:33

Subject: Its Turns out Trickle Down Economics Doesn't Work

|

|

5th God of Chaos! (Ho-hum)

Curb stomping in the Eye of Terror!

|

sebster wrote: sebster wrote:nomotog wrote:That brings up something I have always wondered about trickle down. We know giveing rich people money dosen't mean much because they don't reinvest that into the economy, but what about corporations? A business will spend all there money and then get a lone so they can spend more. What would happen if we just cut the corporate tax to 0?

Any ater tax profit that is not needed for re-investment will be paid to shareholders as dividends.

The problem with trickle down, essentially, is that investment isn't driven by having spare cash lying around. Neither people nor corporations look in the bank, see they've got a spare million and decide to start a new store. Investment is driven by demand - those people and corporations see there is demand in the market that is not met by them or their competitors, and they expand to meet that demand. Maybe they have the money on hand but more likely they don't, at which point they will borrow it.

But the point is that investment comes from there being consumers with cash out there demanding products. This leads to investment, which leads to employment, leading to more cashed up consumers and so the feedback cycle is created. Simply having rich people with money doesn't achieve anything, if there's no investment opportunities for them to seek profits from.

Automatically Appended Next Post:

Vulcan wrote: Vulcan wrote:Remember that: The company only gets money from sale of their stocks when they're doing the selling. Third-party sales mean nothing to the company. And money in the market tends to stay in the market, rather than get out and be used in the wider economy outside the stock exchange.

Umm, no. Money moved through third party sales is never "in the market". It can't be, because for every buyer putting his money in, there's a seller. I buy your BHP share for $50, and I lose $50 but you gain $50. The amount of money in the hands of people to be spent outside the market is unchanged.

Automatically Appended Next Post:

Right now corporations are playing the market rather than investing in their businesses, because they can make more money on the market with the exceedingly low capitol gains tax rate than they can by... you know, doing business.

Raise capitol gains to 35% or so and give a hefty tax break to companies for paying PAYROLL (as opposed to bonuses) and you'll see corporations fall all over themselves hiring people to save taxes.

Make it simpler. Drop payroll taxes. Make them not exist. Don't tax companies for hiring people.

Then do something else even more radical - make company tax 30% or 35%, but stop double taxation when it's paid to shareholders - give those shareholders a tax credit for every dollar already paid on their income by the company.

And don't give capital gains tax its own special treatment. Roll it up into income tax - why should it matter if I profited by selling my labour or selling some land, if either way I brought in $100,000 in the year? Any issues with spikes to income from one time sales can be dealt with under income averaging provisions that are already in place.

That'll give you a healthy shortfall in tax revenue, which you make up by raising the most direct, sensible tax - income tax.

Automatically Appended Next Post:

sourclams wrote: sourclams wrote:Increase capital gains tax, and you create barriers to business, essentially raising the expenses of doing business. That's not even ' IMO', it's basically a textbook definition.

Umm, a tax on profit isn't an expense of doing business, it's a profit reduction. It works entirely differently to variable and fixed expenses.

Then you suggest that tax breaks on head count will offset this expense, but headcount has its own expense associated with it (and a lot of front-loaded expenses, like training and the logistics of dealing with headcount expansion), so all you're really doing is giving a 'buy one, get one free... in six months' coupon.

When something is more expensive, a buyer will buy less of it. This is what's known in economics as fething obvious. Reducing the cost of something makes a buyer buy more of it. Again, the economic term is 'fething obvious'.

Reducing the cost of labour, by removing payroll tax, makes it cheaper. I hope I can now sit back and watch you put all the pieces together.

Hey Seb... I like what you said here...have an exalt. I especially like your point on removing the payroll tax. Automatically Appended Next Post:  Seaward wrote: Seaward wrote:Can't I just vote for Romney now because I make more money than I did when I voted for Obama and want to keep more of it?

Free country... vote how you'd like.

My cuz is voting for Obama because doesn't like Romney's hair...   I think she's joking... maybe...but, I don't really know

|

|

This message was edited 1 time. Last update was at 2012/10/25 02:51:51

Live Ork, Be Ork. or D'Ork!

|

|

|

|

|

|

|